1099 hourly rate calculator

Note your hourly rate before was 50k2040 or 2451 so this is 43 higher. 1099 contractors who are paid hourly may ask for a higher hourly rate than you pay your regular employees.

Payroll Calculator Free Employee Payroll Template For Excel

1099 Tax Calculator A free tool by Tax filling status Single Married State Self-Employed Income Estimate your 1099 income for the whole year Advanced W2 miles etc Do you have any employee jobs.

. Rate Calculator Transitioning from being an employee to being a contractor can take some thought. The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is not an exact calculation of your taxes because many other factors outside the scope of this comparison can affect your tax situation. Net W2 Earnings - - Expected Independent Bill Rate.

In the simplest case you can simply addsubtract 765 half of the total FICA taxes as an easy 1099 vs W2 pay difference calculator for hourly rate. Online calculator should tell you taxes are 9134. If the idea of a big one-off bill from the IRS scares you then you can err on the side of caution and adjust your.

Also generally your income isnt capped. As a 1099 contractor you have higher FICA taxes that total 153 765 more than W-2 but you also have access to deductions W-2 employees do not such as the health insurance deduction and business expenses. See how your refund take-home pay or tax due are affected by withholding amount.

For example a W-2 employee with no benefits and a wage of 25hour would expect to make about 27hour 25 x 10765. Base Salary year. Estimate your federal income tax withholding.

So good - you net the same per year with 68500. Taxes Paid Filed - 100 Guarantee. How to calculate the hourly rate differences between W-2 and 1099 workers You may pay contractors a set amount either hourly or by the project.

Please note that the self-employment tax is 124 for the FICA portion and 29 for Medicare. Choose an estimated withholding amount that works for you. Federal income tax rates range from 10 up to a top marginal rate of 37.

This is a great exercise to come up with a target hourly rate that you can use to start negotiations with a client. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. Annual salary you would like to target.

Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. How It Works.

In a few details below to find out what hourly rate you should target. Use this calculator to estimate your self-employment taxes. Enter your info to see your take home pay.

Divide that gross number by hours worked 1960 and you get 3495hr. Let us help you figure that out. 1099 vs W2 Income Breakeven Calculator.

The rule of thumb for conversion from a full-time salaried position with benefits to an hourly rate as a contractor or freelancer is annual salary 2000 X 2 3 or 4 Your target annual salary divided by 2000 which is the number of. Ad Payroll So Easy You Can Set It Up Run It Yourself. You can generally lower your rate for longer term contracts as your utilization rate will increase.

Use this tool to. Many contractors will outline their payment terms and rates in their contracts. In the Weekly hours field enter the number of hours you do each week excluding any overtime.

However if you are self-employed operate a farm or are a church employee you may owe self-employment taxes. Add that to SE taxes and youre at 18813 total taxes or a take-home of 49687. Normally these taxes are withheld by your employer.

Employee Income Estimate your W2 income for the whole year Work mileage Estimate the number of miles you drive for work for the whole year miles. Monthly Healthcare Contribution month. Adjusting- 91hr08 114hr on 1099 We have put together a calculator you can use here to calculate your personal hourly rate.

Share Improve this answer answered Sep 9 2018 at 1342 Warren Payne 99 1 Add a comment. The most common solution Ive found is to multiply W2 ratesalary by 12 to maintain the same net income which is all I was looking to do. You must enable JavaScript in your browser in order to use this calculator.

Tkngbadh0nkfnm

Interest On Home Equity Loans Is Still Deductible But With A Big Caveat Published 2018 Home Equity Loan Home Equity Home Improvement Loans

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Professional Templates Business Template

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Payroll Tax Calculator For Employers Gusto

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

.png)

1099 Taxes Calculator Estimate Your Self Employment Taxes

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Calculate Your 1099 Hourly Rate No Matter What You Do

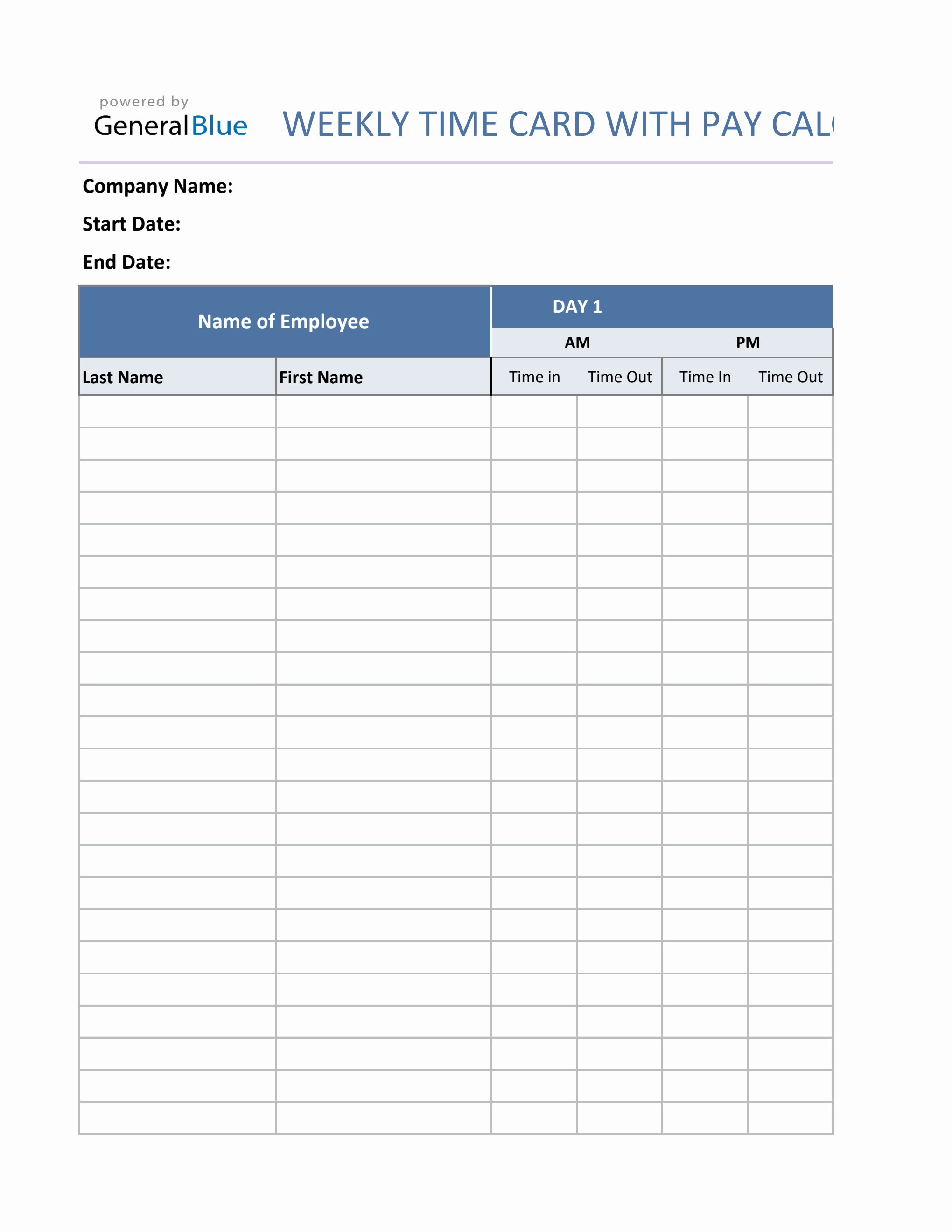

Weekly Timecard With Pay Calculation For Contractors In Excel

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Calculating Child Support In Washington State The Basics

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt